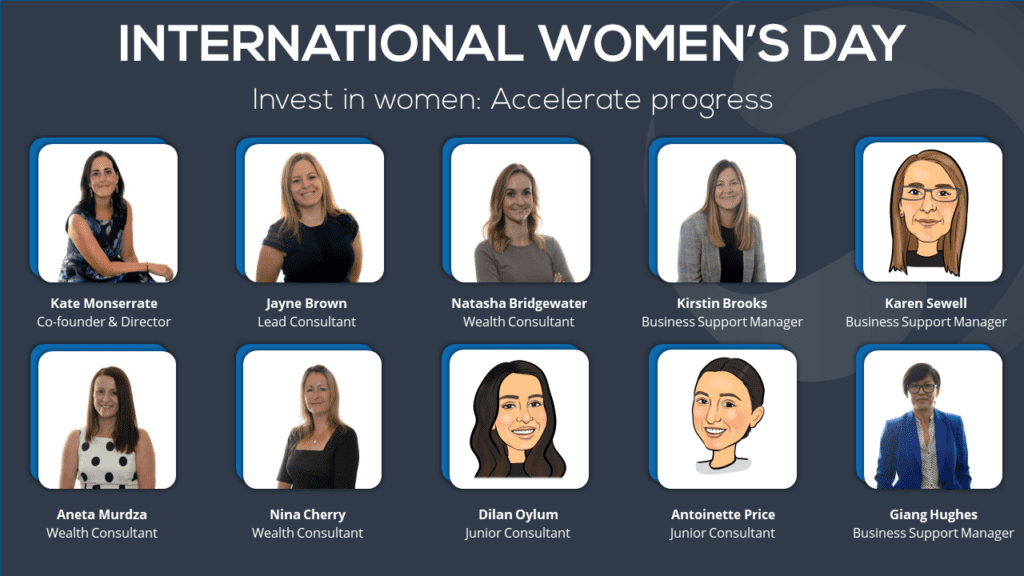

At Simplify Consulting we are proud to be supporting International Men’s Day.

On November 19th International Men’s Day celebrates the positive value men and boys bring to the world, their families and communities. It also highlights positive role models and raises awareness of men and boy’s mental health and wellbeing.

This year’s UK themes are:

- Making a positive difference to the wellbeing and lives of men and boys

- Promoting a positive conversation about men, manhood and masculinity

- Raising awareness and/or funds for charities supporting men and boys’ wellbeing

What impact do high-risk investments have on men’s health?

Mental health and wellbeing play a crucial role for everyone, regardless of age, background, religion or gender. In this article I consider the impact of men’s attitude into high-risk investment portfolios has on their mental health.

There’s not always a direct relationship between risk and reward, but high-risk investments are a gamble. They offer investors the chance of more attractive higher returns than other investment options and when a high-risk investment goes well, it’s great. However, if things go badly, the investor could lose all their money.

The cryptocurrency market for example, is a highly volatile market where investors take the wild ride of big upswings in soaring returns and dramatic plunges of sudden market downturns. Last week we saw FTX’s $32bn empire collapse and the price of Bitcoin fall to a two-year low.

2022 hasn’t been easy and the markets have fluctuated because of many factors – rising inflation and interest rates, manufacturing and production issues, Russia’s invasion of Ukraine and consumer spending has dropped, to name a few.

Whilst the product names and descriptions may change, other examples of high-risk investments available include:

- Equities

- Emerging market stocks

- Emerging market bonds

- Low-grade corporate bonds

- Mortgage-backed securities

- Penny stocks

- Venture capital funds

Different attributes swing investor’s risk appetite between low to high. Men in particular lean towards the high end of the scale, because extra disposable income from higher wages, higher confidence levels and expectations, and greater investment knowledge encourages them to go for an opportunity to yield greater returns, despite the risks.

- A study by BitDegree.org last year revealed cryptocurrencies were among the top 5 financial investment methods for men, and a survey by CNBC found around 16% of men invested in crypto, compared to 7% of women.

- Finder reported in 2021 men are more likely to invest in the UK stock market, with 73% planning to do so vs 61% of women.

- A global survey by BNY Mellon found 45% of women felt investing in general was too risky for them.

- In an article by Money International, 51% of men were confident their investments will deliver strong returns over the next five to 10 years, while only 34% of women thought the same.

A high-risk attitude towards investing and situations like FTX can have a substantial impact on investors mental health and wellbeing, especially when financial concerns for many are a major contributor to stress. This in turn can play a role in the development of other mental health illnesses, for example suicide, which kills three time as men as it does in women.

Other common types of mental health issues which may develop in men include:

- Alcohol and Drug related disorders

- Depression – Over six million men perish from depression each year and for men this is more likely to lead to substance abuse and increased aggression

- Anxiety

- Bipolar Disorder – It’s the world’s sixth-leading cause of death

- Schizophrenia – Men account for 90% of persons diagnosed with schizophrenia under the age of 30

- Eating disorder

Although there’s a wide variety of resources and information available online, investment providers and platforms must play their part, and support investors to make better informed decisions. Naturally, they’re wary of the advice-guidance boundary, however this doesn’t prevent them from adopting the right standards to collate information and help achieve good customer outcomes, especially with Consumer Duty landing next year.

Examples of the right standards should include:

- Better engagement with investors from the outset, asking questions for the investor to consider – do you know your investment goals? Can you afford to lose your initial investment? Do you understand the investment option(s)? Do you know how to exit your investment if needed?

- Summarise and playback key fact and information about the different investment options available, as well as highlight the financial and non-financial risks and consequences if it goes wrong. If the investment provider or platform is regulated, the investor might by entitled to compensation through the Financial Services Compensation Scheme or Financial Ombudsman Service.

- Check investors have considered getting financial advice to better understand achieving their investment goals and the associated risks.

- Continued engagement throughout the portfolio journey; maintain accurate records of the investor’s risk appetite and actively monitor their portfolios, so if the investment doesn’t conform to their risk appetite, provide timely feedback with further options available.

At the end of day, people will continue investing in high-risk portfolios, so it’s important investment providers and platforms take some responsibility for their investor’s mental health and wellbeing, and demonstrate they’ve done enough to help them make sound investment choices.

And if the investment doesn’t work out as expected for investors, it’s vital they feel positive enough during a time of uncertainty, to ensure the situation doesn’t impact their lives negatively.

For more information on mental health and wellbeing, please visit https://www.mentalhealth.org.uk/ or https://www.nhs.uk/mental-health

For more information on International Men’s Day 2022, please visit https://internationalmensday.com (global site) or https://ukmensday.org.uk/ (UK site).

James Wood

Wealth Consultant