Giang Hughes

Business Support

As a consultancy that provides services across the wealth industry, we have seen the impact of the proposed Off-Payroll (IR35) rule change due to come into effect on 6 April 2021.

The changes coming in are designed to ensure private sector employers are responsible for assessing whether or not contractors need to pay income tax and national insurance contributions. To clarify, IR35 tax regulations are not changing, but the responsibility for carrying out the assessment that determines whether an assignment is inside or outside of IR35 is shifting to medium and large-sized end-users.

Simplify Consulting is classified as a Small Medium Enterprise (SME), which as it stands will be outside of the scope of changes. We still have a part to play in terms of understanding end client requirements, nature of the work and all the other elements that are key to IR35 status determination.

Our consultancy engagements are delivered through a combination of our permanent team and the Simplify Associate Network. With an associate network that is mostly made up of contractors who provide services under a personal service company (PSC), the IR35 changes have had an impact on opportunities available to them and how they engage in work.

We recently ran a survey of our associates who have provided contract services in the last two years and the results make interesting reading. The survey asked contractors their thoughts on IR35 and the impact it has had on them leading up to the changes.

SURVEY RESULTS HIGHLIGHTS

Of the contractors that were surveyed 76% said IR35 has had an impact on the decisions they have made on the type of role they have chosen over the last 12 months. This is not a surprise when we look at the responses we have had on questions across their contracting and employment experience. Some of the stand-out findings we have highlighted below.

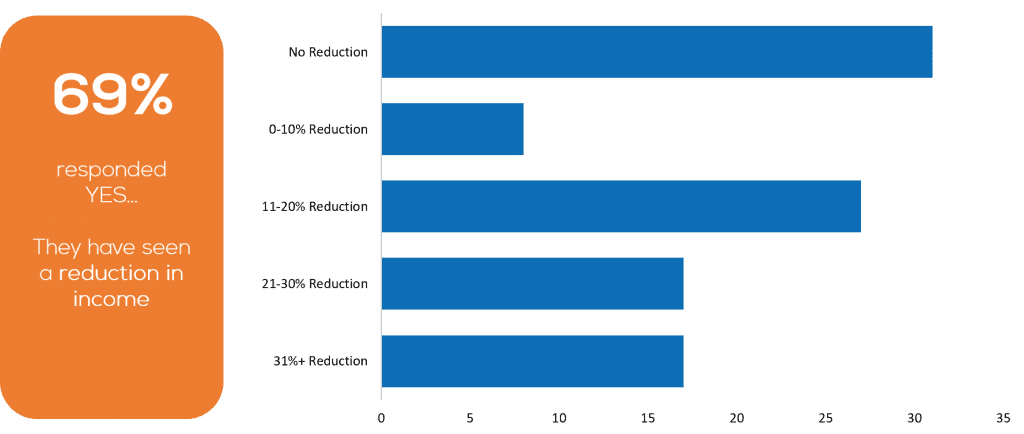

Reduction in income – When asked Have you seen a reduction in income as a result of the proposed IR35 changes? the response was a resounding YES with 69% of our respondents seeing a reduction in income. What stood out was the scale of the reduction in income with 27% seeing a reduction of 11-20% and 17% seeing a reduction of 21-30% and a further 17% seeing a reduction in income by 31% or more.

There could be a number of factors that have resulted in this reduction of income:

Reduction in rates offered – most of our respondents saw a decrease on the rates they were being offered – 12% seeing a decrease between 1-10% and whopping 59% saw a decrease of over 10% of the rates being offered. This is in the last 12 months.

Lack of opportunity – some 29% of respondents had seen the length of their contract being reduced. We also asked how long it took to secure a role. Prior to IR35 changes being proposed 69% took up to 30 days to secure a role but this changed dramatically when asked the same question after the IR35 proposed changes, 39% said it took them longer than three months to secure a role, – a high proportion but to be expected, taking in consideration other economic factors and the pandemic.

Alternative employment route – we asked our respondents their plans post the regulation change in April and a staggering 87% are intending to choose an alternative way to be employed rather than solely through their PSC. Over a quarter (27%) of those asked will look to enter permanent employment.

WHAT OUR RESPONDANTS HAVE SAID

What has given the results of this survey another dimension has been the commentary from our respondents. Many have felt they have been negatively impacted or have had to make difficult decisions about their employment future in an uncertain landscape. All of the quoted comments below are verbatim as written by the survey respondents.

I was in a role outside IR35 for just under two years until July this year. I am now looking for a new role and they are fewer than before because of COVID but the ones that are there are now all FTC or inside IR35 via an umbrella. I still want to operate outside IR35 – not because of the money but because I don’t feel those options are truly independent roles which is what I love. I am however having to flex my wants simply because of the market.

Several respondents felt they were given fewer opportunities to operate as they had before.

“I have taken on BA roles to ensure continuity of work whereas my preference is work as a Business Architect.”

“For 10 months I was out of contract, however in the last 2 months I have been self-employed.”

Whilst others have suffered from the decisions made by agencies or clients.

“The agency that I was contracted with lost most of its contracting clients due to the approach that was adopted by organisations following IR35 guidelines.”

“My current client decided they wouldn’t deal with PSCs post April 5th 2020.”

“Effectively forced into an inside IR35 role due to most large firms making this a requirement”

In the lead up to the date of the original regulation change, a lot of the large corporations were making blanket decisions or choosing to strip away their contracting resources. With the delay was an opportunity for businesses to prepare and refine some of their processes, so a blanket determination could be avoided. However, the commentary from our respondents shows this is not the case.

OUR OBSERVATIONS

The results have confirmed what we had already seen and heard from conversations with associates and wider network.

Matt Short our Business Manager who oversees and manages the Simplify Associate Network shares his thoughts on the survey results.

“This survey concurs with the conclusions of our own discussions with our Associate Network. We speak to contractors regularly and found the proposed changes had already forced many to re-evaluate how they operate once the changes come into force. As we have seen with the findings, this is due to several factors. Many of the big financial services organisations are making sweeping decisions to cut their non-permanent workforce and ending contracts before the rule change.

We have seen this twice, both leading up to original regulation change date in 2020 and again this year as we approach the delayed date. Those that are contracted are becoming available at the end of March as their contracts conclude many are still awaiting news of how their status is being determined by the end-users”.

It is a difficult time for many of our associates as they juggle the desire to be in work and obtaining financial stability and the lack of certainty in the opportunities available to them or lack thereof.

Almost all our Associates contract through a PSC and are a crucial part of our consultancy proposition. Losing access to their genuine B2B services is already being felt and a loss to many businesses.”

Time will tell what the contracting landscape will be like post 6 April 2021. Many more are available for work and for large parts of 2020, supply massively outstripped demand although we can assume the global pandemic played a big part in this. There could be a real loss of skills and knowledge as people move away from contracting particularly for organisations that need short term expertise to make changes and enhancements to their business.

At Simplify we have planned for the potential implications of these reforms, seeking legal advice, keeping up-to-date with the changes and working collaboratively with our clients and Associates to ensure we are clear about our model and ways of working. Our commitment at Simplify is to ensure we continue to facilitate best practice engagement with our associates and clients.

Look out for our IR35 whitepaper coming later in the year that explores the survey results in more detail and reviews the contracting world post the changes.

Simplify Consulting is a practitioner led wealth consultancy providing practical solutions and delivering positive outcomes for our clients, quickly and efficiently.

Watch our video here to find out more about the Simplify Associate Network and contact us [email protected] to join.

To find out more about our services visit our website www.simplifyconsulting.co.uk