Generational Skills Gaps

Global aging is undeniable with virtually every country in the world experiencing growth in the number and proportions of older persons in their population. This is one of the most significant social transformations of our time with implications widespread across all sectors of society including the labour and financial markets. Our workforce is swelling with those of us not considered ‘young’ and our skills shortfall in the new age keeps the skills gap debate alive.

Like many people I have been reading and consuming the coverage on the labour skills gap with research being conducted by many organisations. Most of which shares strategies on closing the skills gap and reveals statistics that throws light and shade on what the future of work could look like. Particularly for someone like me, that’s over 40 and for the next set of workers like my oldest son who will likely enter the workforce in some capacity in the next 5 years.

I am what’s classed as mid-career with real-world experience and the behavioural skills deemed critical to a successful workforce. But are the gaps between my generation (Gen X) that straddles the old school and the advent of smart things and the newest generation (Gen Z) who are living, learning and entering work as digital natives that vastly different? My son will be part of the same club as me (the labour market) for at least 15 years and addressing our skills gaps will be an interesting challenge to see unfold. Are our skills vastly different or is it how we learn and address those skills?

Why is this issue so important? Like so many it felt like only yesterday that I was at the height of my youth, skipping through life when learning new things and retaining information was easy and suddenly overnight, both feet are planted in the mid-life, mid-career quagmire of responsibility. It’s not just about feeling our age but feeling our talent and the pressure of continuing to learn, forge new skills and maintain a career that has meaning and purpose. Can we keep up with moving our careers and advancing our abilities in tandem with the inexorable shift to a digitised and tech enhanced working landscape?

A key statistic of The enterprise guide to closing the skills gap report published by IBM states;

The half-life of professional skills was once estimated at 10 to 15 years, meaning that the value of those skills would decline by half – or half the knowledge associated with the skills would become irrelevant – in a decade or so.

This re-evaluation of the value of our skills is somewhat shocking and the report goes on to say that today the half-life of a learned skill is reduced to 5 years and even shorter for technical skills. This means our learned skills are rapidly becoming obsolete and as Stephanie Kasriel CEO of Upwork points out – we have a job market well into the 21st century and yet how we perform those 21st century jobs are still stuck in the previous century. And she is right, with remote working and freelancing rising and the onslaught of new roles, responsibilities, capabilities in incredibly agile environments not seen a few years ago.

Financial Services Transformation

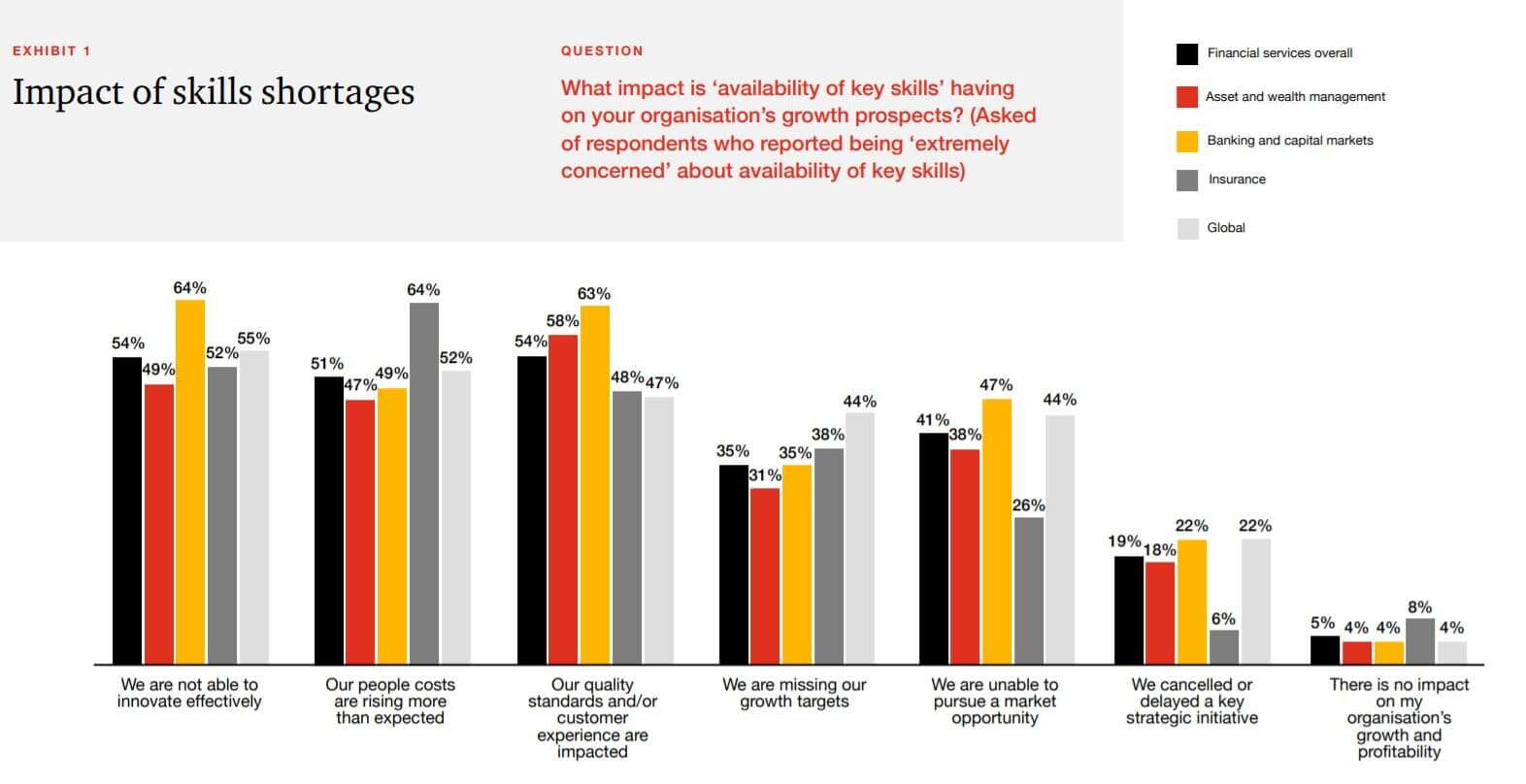

There is no denying that there is a workforce transformation already taking place – if we look at Financial Services (FS) where digitisation is ushering in new kinds of ways of working with agility and digital skills. Our customers are driving the change and are demanding a seamless, omnichannel experience. The massive adoption of new tech in FS such as Artificial Intelligence (AI) and data analytics means the digital transformation is well underway. However, this industry is no different in that it suffers from the skills gap. In a recent report by PwC that surveyed CEOs of FS companies 76% of the CEO’s surveyed were concerned and felt the skills shortages was a threat to their growth prospects as illustrated below.

Source: PwC Financial Services Talent Trends 2019

As much as FS companies are investing vast amounts of money to modernise their systems, use automation to drive down costs and adapt the user experience to meet rapidly changing expectations of their customers, the FS workforce is struggling to gain and learn new skills to help harness the innovation.

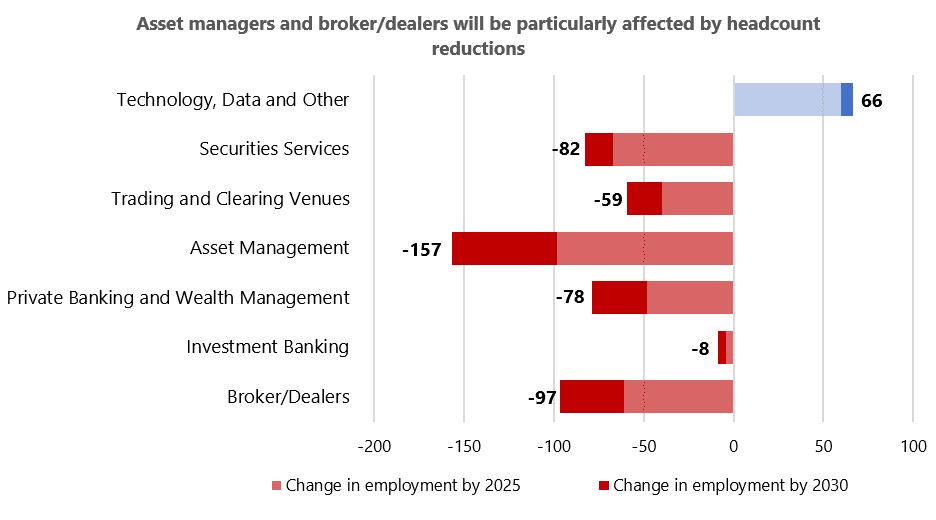

According to Optimas, due to adoption of new technologies and AI, based on their research they expect staff reduction will be huge with 400,000 full time employees lost by 2030 and they see the asset management industry suffering ‘the greatest cutbacks in the workforce, shedding about one third of its headcount’.

Source: Optimas – Headcount reduction estimates by type of institution.

Leading up to this point, recruitment has been heavy on risk management, legal and compliance teams to cope with the new regulatory environment but now the new landscape requires talent with a very different set of skills to deploy and implement the advanced systems.

Let’s look at robo-advice available through an app where you can invest as little as £1 on your phone and choose ethically sound investments in mere minutes – Vanguard conducted their own research and almost 70% of their clients under 40 were either currently using, or said they were likely to use, a robo-adviser alongside their financial adviser. The same group surveyed placed a higher importance to ‘holistic’ planning and building financial confidence and prioritising their goals (which is much harder to automate). This tells us that these ‘digital natives’ want human interaction too and the traditional client-advisor relationship is not dead yet.

One of the initiatives being rolled out in the South Coast of which Simplify Consulting are involved, is Future of Advice in an effort to promote a career in financial advice amongst the younger generation. The aging financial advisor population is an industry problem that needs to be solved with 26% of this year’s Financial Times 400 broker-dealer advisors belonging to the 60-and-over age group. These initiatives make some small headway to closing the divide by giving young people the knowledge and skills to provide the type of services they want as young investors.

As much as there is disruption in how we live and work there’s still a need for both the tech and the people skills.

Closing the skills gap

We know it falls to us as much as the companies that employ us to take a more assertive and positive step to bring our learning and skills up to date, even governments and educational institutions need to ensure education is keeping up the pace. But herein lies the other challenge, the time it takes to close the skills gap.

Globally, in 2014, the median time it took to close a capability gap through training in the enterprise was three days. In 2018, the median was an astonishing 36 days.

Astonishing yes – but the IBM enterprise guide does emphasise, this statistic is based on traditional training approaches like classroom and virtual learning and the disparity is due to the skills needed now, are behavioural and coupled with highly technical skills such as data science, all taking longer to learn. Behavioural skills such as teamwork, communication, creativity and empathy are best learned in the real world and take practice and time. So too the ideal candidates in demand by recruiters now need expertise in business, administration or mathematics as well as specific technologies such as Python and data visualisation.

The C-suite executives surveyed in the IBM 2018 Global Country Survey have recognised that intelligent automation could be an answer and will bring in a multitude of benefits, which means millions of workers will probably need retraining and reskilling. Although digital skills remain a priority there is growing emphasis on inter and intra-personal skills. What is also apparent from their survey responses is that many of them do not believe their organisations are very prepared. So maybe this is where the mid-career professionals can help with the skills challenge. Our hard-earned real-world experiences and honed soft skills are in demand and we can help others to develop those skills. We also need to take ownership of our own development and balance our human skills with tech proficiency.

Several reports point to HR and hiring and training with innovative and intelligent use of Artificial Intelligence (AI) as part of their strategies and recommendations. Firstly, doing it how we have always done it just isn’t enough. One recommendation for closing the skills gap starts with Making it personal. Interestingly the Designing Employee Experience report states that;

We are approaching the workplace as consumers. Individuals want the same experiences in the workplace that they have as consumers.

Few people would be onboard without the right Employee Experience (EX). The millennials have helped us demand a consumer experience that’s instant, intuitive, flexible and personalised and this has seeped through to what we want as employees. Continually shifting skills demands means one-size does not fit all (as if it ever did).

Artificial Intelligence the Answer and the Problem

AI might be an answer to learning amongst many other offerings but seems to also be the basis of widening skills gap too. Take a close look at the private wealth sector that acknowledges it is falling short in the talent that can help it innovate and evolve. As Ian Rumens, Global head of Private Wealth of Intertrust states:

the private wealth industry is facing a growing need for technology-led changes driven by client expectations and the pressures of dealing with an ever-changing and demanding regulatory regime

The Intertrust research goes on to reveal that the demand for AI is creating one of the biggest skills gaps in the sector and this is followed by cybersecurity, blockchain, application development and data analytics as the key technologies exposing the industry to skills shortages.

There is an urgency to harness tech-savvy talent at a senior level and investing in training for existing staff to gain skills needed to keep up with and stay ahead of the technology revolution. Unfortunately, the same research highlights its exposure;

46% of private wealth professionals admitting that their organisation fails to recognise the need to recruit tech talent or invest in internal training programmes in the immediate future

Optimas says 35% of job offers published since January 2019 by US and European sell-side organisations are targeting candidates with a technology profile. But demand has overtaken the supply. One answer can be found with educational institutions trying to ramp up their approach to provide tech skills with many schools building AI and programming skills for their finance graduates. The Berkeley Haas programme (Haas School of Business University of California, Berkeley) provides students mathematical, statistical and computer science skills to succeed in financial markets and includes how to price assets and build algorithms to scour markets to inform and support quant investing operations. But these courses come at a cost and are not readily accessible for all.

Behavioural skills vs highly technical skills

Technology will progress and accelerate, and the professional world will become more complex. So how we enhance and build a multi-disciplined skill set needed to see us through, will continue to be the challenge. What happens when the Generation Z have grown up and the next lot come along? Can we make those advancements ready for the next tranche of humans, the new Gen Tech, iGeneration or Gen Y-Fi?

But maybe let’s take a step back and ask how can we teach, coach and show the new generation how to deploy skills such as empathy, persuasion and critical thinking? Let them in turn teach us to innovate and do it in such a way that uses the tech innovation available. Maybe my son will develop an app where I will be a virtual avatar beaming onto the eyeballs of the new generation engaging and encouraging them to learn creative and social skills?

The future will need to combine these two elements where tech is interlaced with the more traditional human approach and our skills are developed to bring in innovation but also develop what will distinguish us from the machines.

Contact [email protected] to partner with us and let us help you get connected with the right talent.