Following 2014’s Pension Freedom regulations, the government launched Pensionwise. It’s a free and impartial guidance service for people over 50 with a Defined Contribution Pension – to help them understand what they can do with their pension pot(s)

It’s fair to say that take up has been low. In fact, only 14% of 50- to 64-year-olds accessing their pension have sought guidance from Pensionwise. (1)

In response, from 1 June, the government will introduce new regulations, compelling pension providers to give savers a stronger nudge towards this service.

The rules apply when customers are making direct contact and not through an adviser. The aim is to get more people using guidance and encourage better choices when accessing pension savings.

Is this regulation really needed?

It’s understandable the government is looking to support consumers.

Choosing how consumers access their acquired pension funds is one of life’s most important financial decisions. A poor decision could have major impacts to quality of living in later life, particularly as many options are irreversible. Consumer understanding is often lacking in pensions due to the complexity and number of options available at retirement age.

A recent study conducted by Standard Life found that 62% of UK adults admit they focus on the early active stages of retirement and avoid thinking about being older when they might be less mobile or in poorer health. (3)

Although the number of people using Pensionwise is low, around 88% of people who attended appointments believed their understanding of their pension options increased. The FCA clearly sees this as a service that adds value, particularly if the consumer is reluctant to seek regulated financial advice or are unaware of the benefits advice can provide. (2)

Does the regulation go far enough to bridge the advice gap?

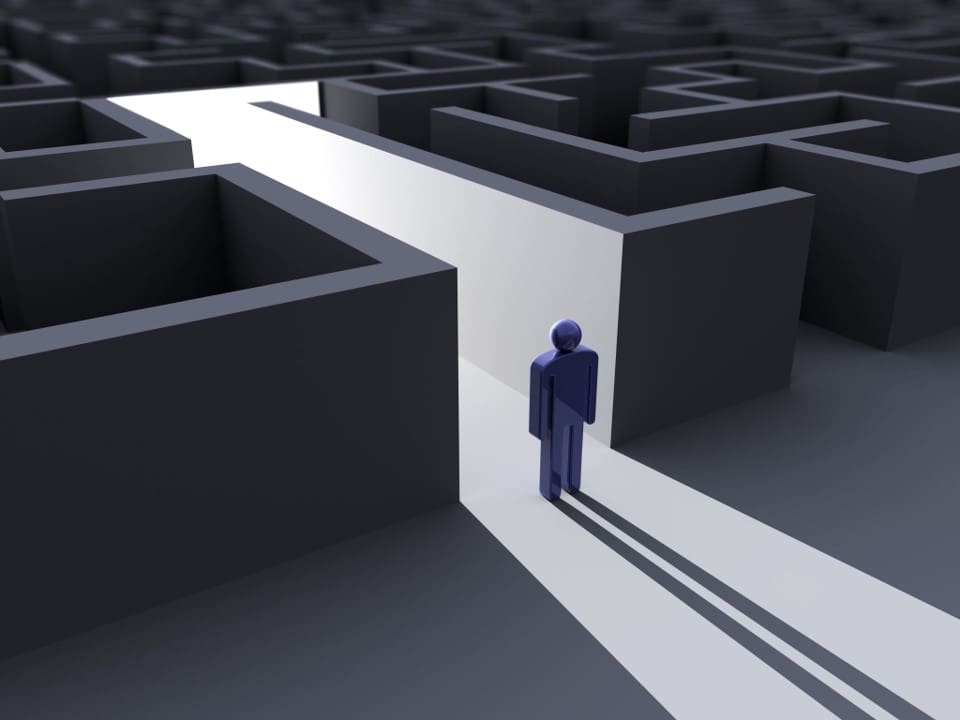

By the time millions of people have reached retirement age and considered their options, it’s almost too late to make financial decisions to change the outcome to how far their pension will go to provide an expected comfortable retirement.

Savers need to be nudged towards guidance far earlier than the final lap before retirement. Judging how much to contribute to a pension over a lifetime is an extremely important factor and this legislation doesn’t cover that.

A further emphasis or ‘nudge’ to seek guidance or advice should be promoted much earlier to incorporate other pension interactions that occur throughout a lifetime.

Will customers see this in the same way?

It depends on the size of the pension pot.

Since 2015, pension holders don’t have to be tied down to an annuity and are able to receive a full lump sum payment. This was widely received as a positive change and beneficial for those with smaller pots, where taking an income will make little difference to their quality of living.

We could see a lot of frustration here – from small potholders to those with bereavement claims, because, in such cases, nudging could be seen as a barrier: yet another hurdle in a lengthy process, which they need to overcome to gain access to the funds.

The same could be said for transfers. The process time has been increasing over the last few years due to the sheer number of people that fall victim to pension scams. Quite rightly, consumer protection is top of the agenda when transferring out, however adding further steps into the process could test their patience even further.

We’ve seen this type of reaction when risk warnings were introduced shortly after Pension Freedoms. Customers had usually made their decision, wanted the funds or transfer completed as quickly as possible and saw little value in seeking guidance. Providers need to be prepared for a similar reaction – and think about how they’ll nudge people who don’t want to be nudged.

Whilst there’s also a requirement for the provider to request confirmation from the customer that they’ve attended an appointment and received Pensionwise guidance, there’s no requirement for the customer to provide proof. Therefore, the cynic in me wonders how many people will just say they’ve attended the appointment or opt out to ‘tick the box’ and progress with their application.

Although future regulations may make it harder to simply opt-out of the guidance, I wonder whether we will see a substantial increase in the take up of Pensionwise in the short term.

Embedding the process and assessing the success rate will take time to understand. It may depend how providers capture information, including behavioural patterns to truly determine whether the regulation is meeting its objectives. If the number of ‘opt outs’ is high across the industry, then more emphasis on determining the root cause should be captured, which could allow for improvements to be made to processes and customer experience.

Is there a lack of understanding of what Pensionwise can offer and how it works?

The pension industry has an important role to play with increasing consumer understanding and promoting the Pensionwise service.

From a customer perspective it will be beneficial to understand: –

- How long are the appointments?

- What is the availability?

- Can I contact online or by phone?

- Could this delay my claim?

- I have many different pension providers; will I need to follow the same process for all of these?

When providers are considering how to address these issues, we urge them to remember the importance of convenience. Customers may be put off by lengthy appointments or lack or availability and may feel that opting out will save them from a lot of hassle and time, even if they believe that seeking guidance will be beneficial for them.

This all comes back to robust processes and making the customer experience as best as it can be.

The danger is, that if there are a lot of negativities in the first few months, it will be difficult to recover and advertise this as something that will truly benefit people on the verge of profoundly important decisions.

My colleague Nina Cherry wrote about the operational impacts that should be considered with this regulation. (4)

If you need any extra assistance to ensure you’re operationally ready in time, we’d be happy to discuss how Simplify could help you deliver. Please get in touch via [email protected].

Sources:

Nina’s Blog

(4) Nudge, Nudge – Wink, Wink – Simplify Consulting

..

Dean Bartlett

Wealth Consultant