Last week was Mental Health Awareness week, a key week in the year which promotes awareness of mental health. One of the consistent underlying themes each year is the impact of financial worries on mental health… your financial well-being. We look at the evidence that connects financial well-being and mental health and what firms are doing to support their customers.

Financial well-being allows people to focus on their goals and aspirations, leading to a higher sense of life satisfaction. When we manage our finances better, feel secure, and make informed decisions, we experience less stress, improved mental health, and better relationships.

The Interconnection with Mental and Physical Health: A Deeper Dive

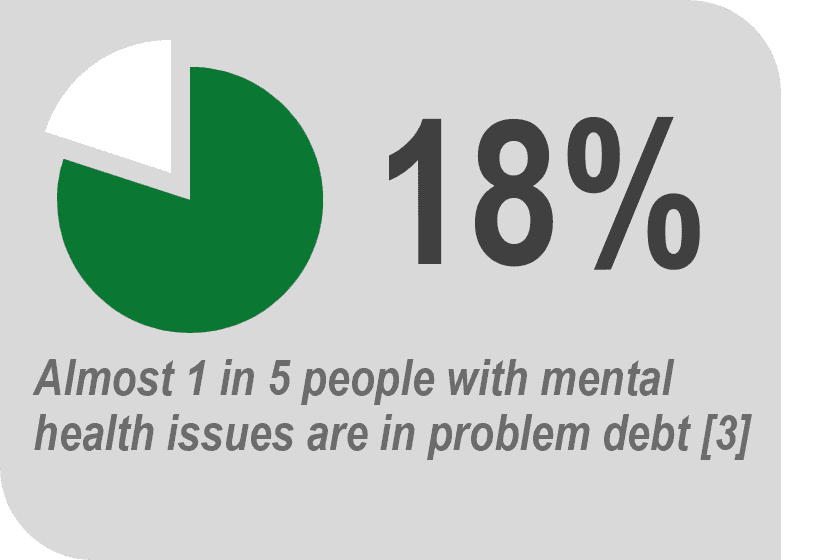

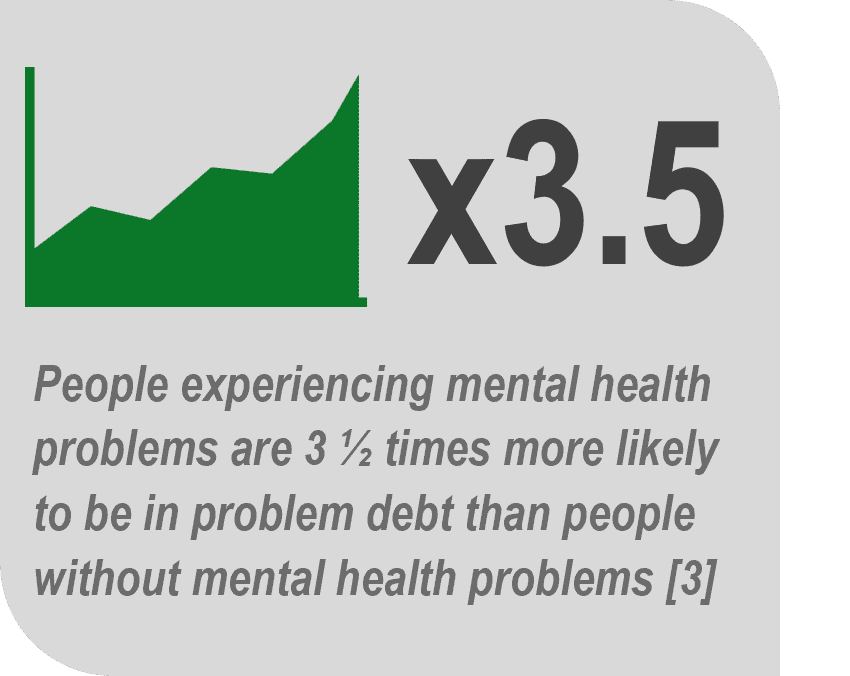

A staggering 1 in 4 people experience mental health issues each year, and in England this comes to an estimated cost of £105 billion1.

With over a decade of austerity in the UK, reforms to universal credit and high inflation we are in a cost-of-living storm, which for many, there appears no way out financially. As such, financial stress has been proposed as an economic determinant of depression2 in a bid for it to get the attention, and funding it desperately needs.

Mental health can have a huge bearing on the way we deal with money, including:

- A lack of motivation to manage finances can come from depression or if you’re feeling low. In turn they are given a lower priority.

- Spending may give you a brief high, so you might overspend to feel better.

- You might make impulsive financial decisions when you’re experiencing mania or hypomania.

- If your mental health affects your ability to work or study, this might reduce your income.

- You might avoid doing things to stay on top of your money, like opening bills or checking your bank account. You might try to avoid thinking about money completely.

Despite its importance, financial well-being is often not given the same level of concern as mental and physical health, why is this?

To address these issues, it’s essential to foster an environment where financial well-being is openly discussed, barriers to the right services are taken down and that education doesn’t start when you begin your first job or turn 18, it should start when you learn Pythagoras theorem!

Education: The Key to Financial Empowerment

Education is a powerful tool for breaking the cycle of financial illiteracy. Learning about investing, mortgages, debt management, and pensions at school and in higher education can prepare individuals for the financial challenges of adulthood. These are the things we encounter at many stages throughout our life, but for many, it’s a big unknown. Making the wrong decision could have implications down the line, which can easily destabilise your general well-being. By embedding financial education into the curriculum, we can empower young people with the knowledge to make informed decisions and build a secure financial future. But until that point, it’s important that financial firms, and those that operate in the wealth space, continue to provide support and services to the customers of today, and tomorrow.

We found some great free examples…

|

Money Heroes Program by Young Money |

Equips young people with the knowledge, skills and confidence to manage their money well. It ensures learners grow to understand their attitude to risk and become aware of their own behaviour and emotions when making financial decisions through real-life scenarios. | 3-11 years | https://www.young-enterprise.org.uk/ |

| MoneySense by NatWest | MoneySense is a free financial education programme that aims to help 5–18 year-olds in the UK towards a better financial future. It uses the key money moments in a young person’s life – starting to save their pocket money, opening a bank account or getting their first mobile phone – to make learning about money feel relatable. | 5-18 years | https://natwest.mymoneysense.com/home/ |

| The Money Charity’s Teacher Resource Packs | Empower people across the UK to develop the skills, knowledge, attitudes and behaviours to make the most of their money throughout their lives. By proactively providing education, information, advice and guidance to people of all ages and at all stages of life, helping them get to grips with their money and increase their Financial Wellbeing. | All ages (Children through to Adults) | https://themoneycharity.org.uk/ |

| MyBnk | Expert-led workshops that cover budgeting, saving, student finance, and entrepreneurship. | 5-25 years |

Barriers to Financial Advice

Many adults today didn’t have the opportunity for financial education during school and higher education and relied solely on jumping in at the deep end, self-learning, family, and friends. This has created a great unknown around financial advice, the benefits, and why it’s so important to make informed decisions when dealing with money.

One of the industry’s biggest issues is access to financial advice, yet it still remains out of reach for so many. The cost of financial advice often presents a barrier, especially for those with lower incomes or smaller saving pots, who may find it difficult to justify the expense. An eye watering 39% of UK adults (20.3 million) lack confidence in managing money; with over 11.5 million having less than £100 in savings4. It can’t solely be put on advisers themselves to bridge this gap, the whole wealth industry and government have a part to play.

For advice firms, it doesn’t need explaining that those with less in savings are less lucrative – at the end of the day, these firms have their own overheads to cover. This creates a vicious cycle where those who most need financial guidance are the least likely to receive it.

In a positive step forward, the FCA, in conjunction with HM Treasury are setting proposals to address the advice gap, and barriers we see in place today. This is an important move which could see firms broaden advice boundaries, allowing better support and guidance (not advice) for those that need it most. An example of this is that firms could provide suggested products or courses of action based on the customers identified target market, this approach is akin to a “people like you” type of recommendation. Importantly, this support could be offered without explicit separate charges, avoiding the need for adviser charging.

The impact this could have on customers could life changing, but for advice firms there remains many unknowns. You can find out more about our thoughts on the FCA’s proposals here.

Wealth plays such an important part…

We’ve covered the importance of financial education, but this shouldn’t be a one and done, it’s something which should follow you throughout your life. The wealth industry plays a significant part in our lives, from saving for that first mortgage, protecting your income and family, planning for retirement to support with a bereavement. The latter, as an example, is an extremely stressful and upsetting time, putting many into a vulnerable position which also puts a significant strain on someone’s mental wellbeing. So, it’s incredibly important that all wealth firms within the value chain are doing what they can to better educate their customers – this includes access to support services, tools, and literature in an easy, consumable, and accessible way (think Consumer Duty)!

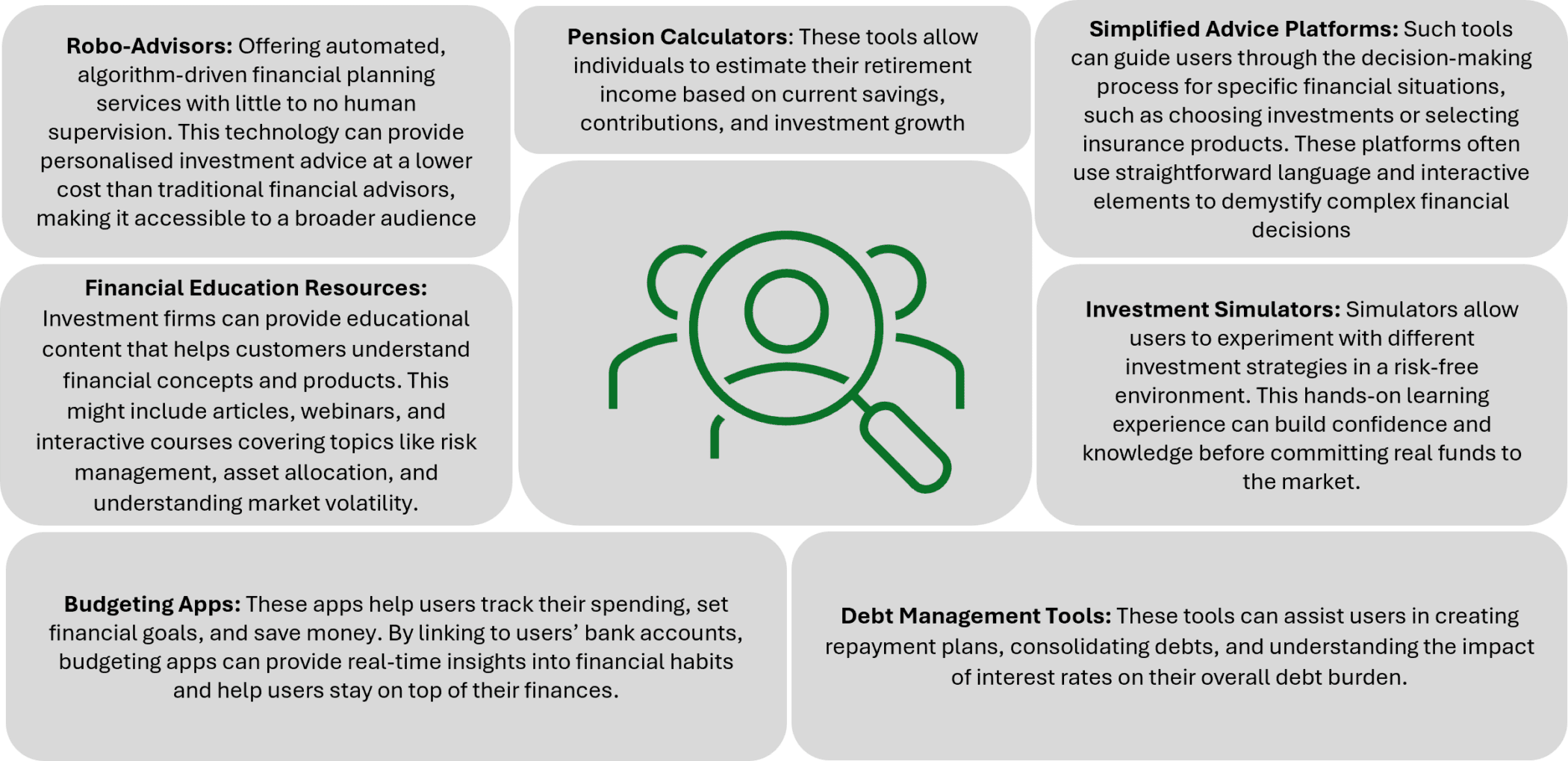

Here’s some examples of tools and services available within wealth:

Whilst tools and services are essential to support financial wellbeing, features and additional benefits within products can also support customers throughout their financial journey – we looked at a few in examples the wealth market today to better understand how these can help customers both from a financial wellbeing and mental wellbeing perspective. More good examples are available, and you should speak to your provider for more details.

|

Provider |

Feature Reviewed | Support for Financial Well-being | Mental Health Impact |

| Interactive Investor | Low flat fee structure | Helps with predictable budgeting and potentially significant cost savings for larger portfolios. | Reduces financial anxiety by providing a cost-effective way to manage investments, offering peace of mind. |

| Moneybox | Rounding-up savings feature | Automates savings to make financial growth feel attainable and manageable without overwhelming the user. | Lowers barriers to financial planning, reducing anxiety and helping users develop a positive approach to saving. |

| PensionBee | Pension consolidation service | Simplifies managing retirement savings by consolidating multiple pensions into one plan, enhancing financial tracking. | Alleviates stress from managing multiple pension accounts, promoting a sense of control and financial security. |

| Nutmeg | Automated investment management based on personalised risk profiles | Optimises investment returns through tailored risk management, minimising the need for active day-to-day management. | Minimises stress associated with investment decisions and daily market fluctuations, supporting overall mental ease. |

| Hargreaves Lansdown | Extensive investment options and robust tools | Enables informed investment decisions through comprehensive tools and resources, enhancing potential financial outcomes. |

Provides empowerment and reduces investment-related anxiety by offering knowledge and user-friendly tools. |

Steps are very much in place to better support financial wellbeing – drives to communicate, service and support customers are coming into place through Consumer Duty, but there’s still a long way to go.

The Risks of Neglecting Financial Well-being

Whilst we have seen some great examples of support on offer, ignoring financial well-being can have far-reaching consequences that extend beyond one’s bank account. We’ve touched on how financial and mental health are intrinsically linked to one another, and the impacts of not acting, supporting, and educating can be significant.

- Mental Health Decline: The stress of financial insecurity can lead to mental health problems such as anxiety, depression, and a sense of hopelessness, impacting overall quality of life.

- Increased Debt: Without proper budgeting and financial planning, individuals may find themselves accruing more debt, which can spiral out of control and lead to severe financial distress.

- Poor Credit Score: Failing to manage finances can result in late payments or defaults, which can damage credit scores. A poor credit score can restrict access to loans, housing, and even employment opportunities.

- Physical Health Problems: Chronic financial stress can lead to physical health issues, including high blood pressure, heart disease, and other stress-related conditions.

- Relationship Strain: Money issues are a common source of conflict in relationships, which can strain or even break family bonds and friendships.

- Reduced Retirement Savings: Without attention to financial planning, individuals may find themselves without sufficient retirement savings, leading to a less secure and potentially impoverished retirement.

- Economic Inequality: On a broader scale, the collective neglect of financial well-being can exacerbate economic inequality, creating wider gaps between different socioeconomic groups.

In conclusion, financial well-being is an essential aspect of holistic health, intertwined with mental and physical well-being. It’s imperative that we address the barriers to financial advice, enhance financial education, and hold the wealth industry accountable for supporting financial health. By doing so, we can create a society where financial stability is a reality for all.

References:

1 MHFA England

Mental health statistics · MHFA England

2 National library of Medicine

Financial stress and depression in adults: A systematic review – PMC (nih.gov)

3 Money and Mental Health

Money and mental health facts and statistics

4 Financial Capability

Key statistics on UK financial wellbeing, numeracy and – FinCap

..

Chris Lamb

Wealth Consultant

Let us know how we can help you by getting in touch today using [email protected]

Practitioners, Proportionate, Professional. Simplify Consulting. It’s what we do.