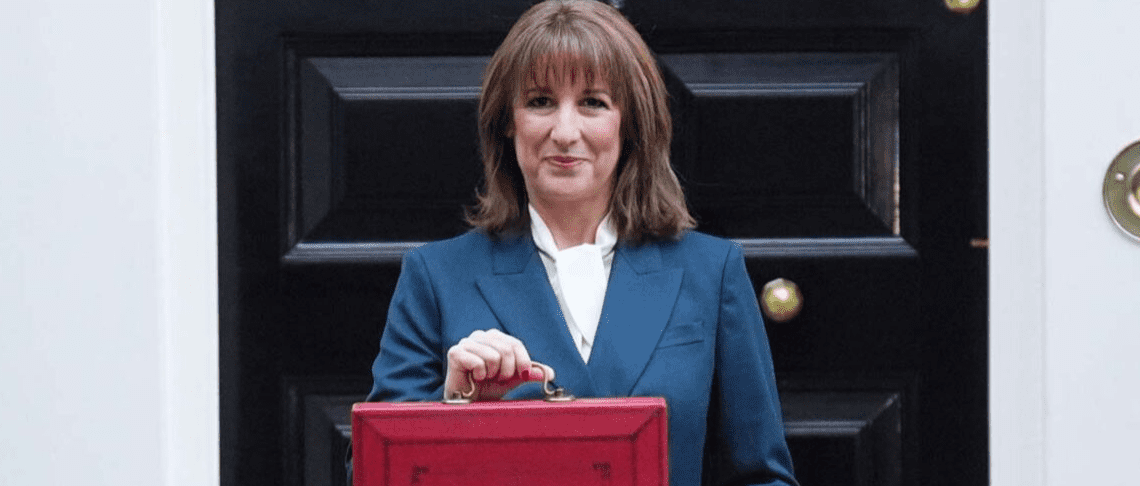

Are women and business the big losers of the chancellors budget?

The Chancellor’s Autumn Budget set out a significant change to the ISA system. The overall £20,000 annual ISA allowance stays in place, but there is now a limit on how much of that allowance can be placed in a cash ISA. People under 65 will be able to put no more than £12,000 per year into a cash ISA, while those aged 65 and over will keep the full £20,000 cash ISA capacity. The change is scheduled to apply from April 2027.

The government’s aim is to encourage more people to invest rather than keep money in cash.

How the changes affect savers… A clear divide between age groups

People aged over 65 remain largely protected. They can continue saving up to £20,000 a year in cash ISAs, which avoids pushing older or retired individuals into investment products they may not want or need. Many already have well-established savings, so the adjustment does not meaningfully change their financial planning.

People under 65 will feel the real impact. Although the total ISA limit remains the same, a much smaller portion can now stay in cash. Anyone who prefers to save steadily, or who relies on using the full cash allowance each year to build up reserves, will need to reconsider how they distribute their savings.

Why this matters more for people still building wealth

Older savers often already hold substantial savings and investments, so restricting future cash contributions does not affect their existing pots. Younger savers are in a very different position. They depend more heavily on annual contributions, so being pushed toward investments affects their strategy immediately. Some may welcome the encouragement to invest. Others may find it uncomfortable, especially those saving for short or medium-term goals.

The deeper impact on female savers

Women are more likely than men to save through cash ISAs and less likely to use Stocks and Shares ISAs. This consistent pattern shows up across multiple industry surveys and official data. As a result, women will feel the effects of the new rules more strongly.

For many women, cash is the preferred choice because it feels safer and easier to understand. The reduced cash allowance challenges this approach. Some may now feel pulled into investing before they feel ready. Without good guidance and suitable low-risk investment options, the change could unintentionally widen the gender wealth gap.

Younger women saving for things like a house deposit or an emergency fund may need to consider several options. They might continue putting up to £12,000 into a cash ISA, place any additional savings into a Stocks and Shares ISA using very low-risk funds, or put the rest in ordinary savings accounts while accepting the loss of tax protection. Clear communication from providers will be essential to help women make confident choices.

How the changes affect businesses… Cash-focused providers face challenges

Banks and building societies rely heavily on cash ISA inflows as a source of stable customer deposits. With the cash allowance cut for under-65s, future inflows into these products are likely to fall. This may reduce the pool of retail funding used for mortgages and other lending. Smaller providers, specially building societies, could be disproportionately affected.

If deposit growth slows, some firms might face pressure on profit margins or find themselves more reliant on wholesale funding. These are meaningful strategic shifts for a sector that traditionally depends on customer savings.

Providers who do not offer investment ISAs will need to adapt

Businesses that only offer cash ISAs may find themselves losing customers to providers that can offer both cash and investment options. To stay competitive, these firms may need to expand their product range by launching Stocks and Shares ISAs or partnering with investment platforms to deliver them.

This may involve operational changes, new customer journeys, updates to advice and guidance, and new compliance frameworks. Not all providers will have the resources to do this quickly, so the market may see more partnerships or consolidation.

Operational questions and regulatory work

Providers will need to update their systems so they can track the new contribution limits and ensure customers do not exceed their cash ISA cap. They will also need to create clear explanations for customers about how the new rules work. This is especially important for people unfamiliar or uncomfortable with investing. All with the knock-on effect of impacting margins or being passed onto the customer.

What savers and businesses should now consider

For savers, especially women and younger generations, the key message is that your current cash ISA remains safe. What changes is how much you can add each year. It may be helpful to think about whether you are comfortable investing a portion of your savings, and if so, how to choose low-risk options that match your confidence level and time horizon.

For businesses, now is the time to assess product ranges, plan for customer communication, and decide whether to expand into investment ISAs. Firms that rely heavily on cash ISA inflows should model the financial impact and prepare for potential changes in customer behaviour.

The overall success of the policy will depend on how well savers are supported along the way. If people feel pushed into investing without suitable advice, the reform may discourage saving rather than encourage healthier financial habits. Well-designed products and clear explanations will play a crucial role in shaping the outcome.

Is your business ready for the new ISA environment?

Simplify Consulting is here to help financial providers navigate the operational, strategic, and regulatory challenges brought by the Autumn Budget’s ISA reforms. Whether you’re a bank, building society, or financial services firm, our experts can support you in:

- Assessing and updating your product range to stay competitive as cash ISA inflows change

- Expanding into investment ISAs or partnering with investment platforms

- Streamlining operational processes and compliance frameworks for the new contribution limits

- Enhancing customer communications to build trust and guide clients through change

Let’s turn regulatory challenges into opportunities for growth and innovation. We can help your business thrive in a shifting market.