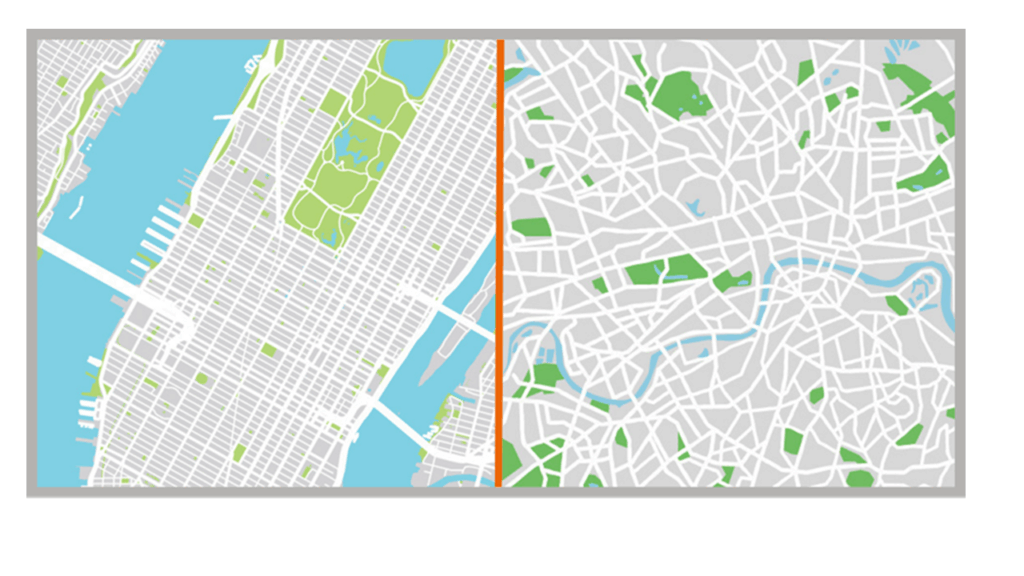

Whilst work began on the UKs first pensions dashboard many years ago, 2025 has seen a huge amount of progress with hundreds of pension providers and schemes now connected to the pensions dashboards ecosystem, covering over 60 million pension records, with a further c.40 million to go by 31st October 2026. It’s hoped that the public will be able to access the MoneyHelper public dashboard at some point in 2026 or 2027. These dashboards will be revolutionary in giving pre-retirement individuals the opportunity to be able to see details of all their workplace, private and state pensions consolidated in one place, via a secure online platform. Amongst the many benefits this will deliver, it will offer people a clearer picture of their total pension wealth, reducing reliance on fragmented paperwork and outdated records, as well as helping people identify and recover lost or forgotten pension posts. The provision of this information will help to support informed decision-making around retirement planning, estate distribution and financial legacy.

Could pension dashboards help estate executors quickly locate unclaimed pension assets after someone’s death? Identifying pensions in payment is more straightforward as it’s easier to see incoming payments, but depending on the record-keeping of the deceased, finding unclaimed assets can be time-consuming, especially as people hold more jobs over their lifetimes. Typically, an estate executor would have to go through a discovery phase. This could involve searching through the deceased’s paperwork, emails, and digital files for pension statements, login credentials, or correspondence with pension provider; using the Government’s Pension Tracing Service to try and locate lost or forgotten workplace and personal pensions; or even engaging professional asset search services. And then once schemes have been identified, comes the notification stage, where administrators must contact each provider to report the death and request details of the pension benefits, balances, and any death benefits payable.

As unclaimed pension values rise—currently estimated at £31.1 billion, with around £15 billion linked to deceased members—efficient tools are increasingly important for probate processes.

Imagine a utopia whereby there is seamless integration between the Government Tell Us Once service and the pensions dashboards. So, when you report a death, it automatically notifies the dashboard, which in turn provides a summary of all the deceased’s pension assets and triggers a verified death notification to be sent to all of the relevant pensions providers. Obviously, there would be a lot of work involved to make this happen, so an alternative option would be to provide a way to associate an executor or Personal Representative to the deceased so that they can access the dashboard information directly, understand where the deceased has pensions assets, and locate the contact details of each of the providers. Either solution would really help speed up what can be a long and stressful process and help get money paid out to beneficiaries at a time when they are vulnerable and likely very much in need of it.

Is it likely to become a reality? Currently the focus of the dashboard is very much on providing information to living individuals so that they can use this to understand how much income they’re likely to receive when they retire, and plan accordingly. As such, it includes stringent Iog-in protocols to identify and verify the user via the GOV.OneLogin function to ensure that only the owning individual accesses the pension information. The data that’s returned primarily includes the accrued value from each of their pension plans, plus the all-important Estimated Retirement Income (ERI). It does not provide death in service or death in deferment values, which can be complex and variable, but does include an indicator to state whether survivor benefits may be payable.

So, a bereavement use-case isn’t currently on the roadmap and given it’s not a feature that has been provided on other dashboards that have been implemented worldwide, it’s not likely to become a reality for quite some time. Whilst technically feasible, it would be complex, and any serious consideration of this use case would be particularly complicated from a data security and legal point of view. Speaking to Richard Smith, Independent Pensions Professional, he agrees “it’s definitely a ‘Version n’ feature. But maybe the inclusion of unused pensions within IHT calculations which comes into force from April 2027 could potentially push it up the priority list”.

The Pensions Dashboards Programme does intend to include a function to enable users to download their pension information. This can then be printed out, stored or shared securely to any other trusted tool or app such as a digital vault. So, whilst this may be a little clunky and manual, in the short-term at least, we can focus on encouraging clients to make use of this. This would help to ensure that pension details are readily accessible and can be shared with family members or potential beneficiaries, forming a vital part of comprehensive estate planning.

As we await the full implementation of the Pensions Dashboards, meaningful steps can be taken now to support clients in managing their pension assets more effectively. Raising awareness of the dashboards and their future capabilities is key, along with encouraging clients to engage with the dashboards, to help them build a clearer picture of their pension holdings, including any forgotten or unclaimed pots. By taking these steps now, we can help clients avoid future complications, improve transparency, and ensure that pension assets are properly accounted for in wills and probate processes. At the same time, we can get involved in advocating for the dashboard’s bereavement use-case, to demonstrate to those in charge of the roadmap the value and benefit that it would deliver in the probate process.

Meanwhile, at Simplify Consulting we continue to work with a range of wealth providers, offering support in the optimisation of their bereavement processes and the communications they provide to their clients relating to investment, life and pension products. We are also working with our pension provider clients to ensure they are ready for dashboard connection in terms of data quality and availability; and operational readiness relating to the anticipated increase in service requests off the back of dashboard usage. Longer term we will remain close to the ongoing evolution of dashboards, so if you would like to find out more about how we could support you, please get in touch.

Sources:

- Pensions Policy Institute. (2024). Lost Pensions Survey. Available at: https://www.abi.org.uk/globalassets/files/publications/public/lts/2024/20241024-ppi-bn138-lost-pensions-2024-final.pdf (Accesses 24/10/2024)

- Katie Elliott. (2023). You could be entitled to your deceased relatives’ lost pensions – here’s how to check. Available at: https://www.express.co.uk/finance/personalfinance/1826903/lost-pension-deceased-relative-how-to-claim (Accesses 23/10/2023)

Nina Cherry

Wealth Consultant