The Countdown Begins

It is less than a year until all in-scope schemes need to be connected to the UKs first MoneyHelper Pension Dashboard, making it viable for a public roll out. With the roll out expected in the next 12–24 months, it’s not just a tech milestone, it’s an operational reckoning with a looming impact on service. Operational readiness is not optional, it’s urgent, and providers who are not ready will feel the strain fast.

“31% of schemes expect 50%+ member engagement in month one1”

There is a growing appetite from the public and with a proactive roll out programme likely from the Pensions Dashboards Programme (PDP), it is anticipated that there will be an early surge in usage as many people will be prompted to engage with their pensions for the first time in years. A recent survey found that 31% of UK pension schemes expect over half of their members to log into the dashboard within the first month1.

Dashboards introduced in other countries have sparked a wave of member queries, and UK providers should expect similar patterns. While engagement varies by demographic, experience from the Netherlands and Denmark shows older users and those with higher contributions are most active – an insight worth factoring into planning. Whilst the Dashboard will offer clearer pension information, it is geared at providing a picture of current accrued value and Estimated Retirement Income, and is limited in other respects. Initially, users may review their data without acting – granting a period of ‘calm before the storm’ – but once they digest the details, questions and requests for support are likely to follow.

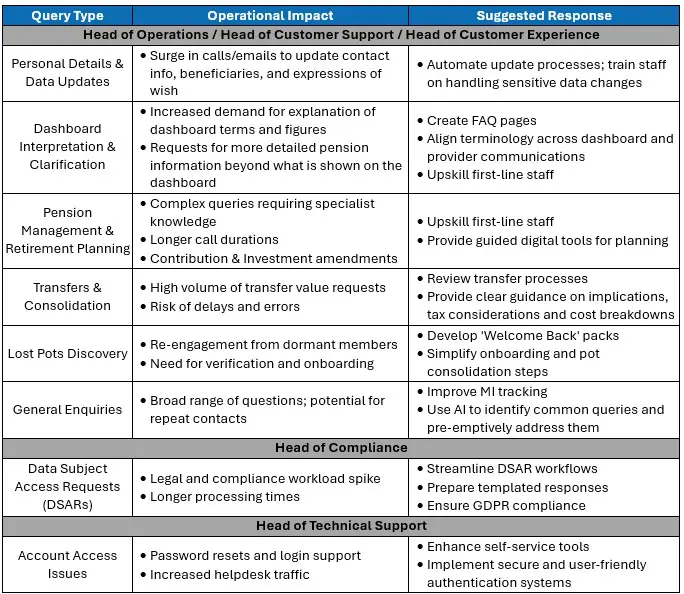

Operational Consequences: What’s Coming Your Way

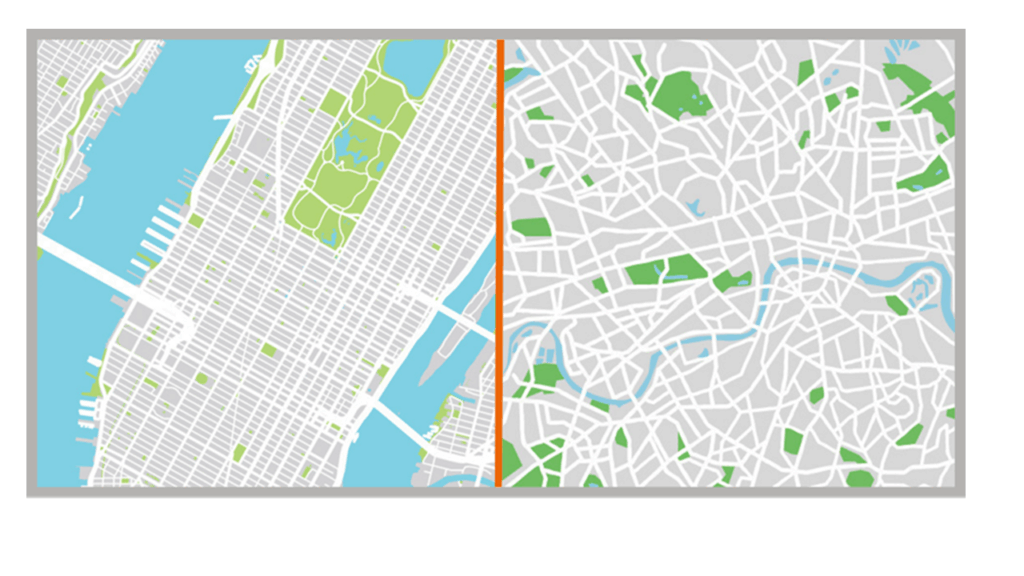

Firstly, there are the ‘red’ results that could be returned on the dashboard in relation to partial or possible matches – as per the example shown below – where the pension provider or scheme needs further information from the user to be able to complete the matching. These will drive a surge in queries to clarify whether the person has accrued benefits with that provider.

Providers are also likely to see an increase in the following types of queries.

Operational Readiness: What You Can Do Now

Customer service teams

Scale support for to manage higher query volumes. Train teams on Pensions Dashboards content. Ensure first-line staff have sufficient knowledge and resources for common queries and clear escalation paths for complex cases.

Communications

Update online resources and comms to answer common questions, give clear guidance, and align with dashboard terminology to avoid causing confusion. Add dashboard signposting to annual statements. Consider a ‘Welcome-Back’ pack for re-engaging previously unreachable members.

Processes

Review and optimise servicing processes – maintaining personal details, amending contributions, updating investment choices, DSARs, updating beneficiaries and (dare I say it!) transfers – for faster turnaround.

Management Information (MI)

Enhance MI to track query types, volumes, resolution rates, and repeat contacts. Use insights to address bottlenecks, plan resources, improve service, and feedback to the PDP to inform future dashboard enhancements.

Data Governance & Security

Ensure UK GDPR compliance, strong governance, accurate data, third-party oversight (including regular audits and due diligence checks), and clear incident response plans to manage data breaches. Essential steps to protect data, meet compliance obligations and build member trust.

As the PDP scales up consumer testing, thousands of people are likely to get involved. I believe that once this high-volume testing gets underway, providers are likely to see a gradual increase in queries, offering a valuable soft launch opportunity to test readiness ahead of full public roll out.

Conclusion: Act Now—Time Is Running Out

Pensions dashboards are about to radically increase member engagement, and a surge in queries is imminent. If you’re not ready, your operations will be overwhelmed, leading to longer wait times, frustrated members, and burnt-out teams. The window to prepare is closing fast.

Those who act now can turn this threat into an opportunity: strengthen your support systems, streamline processes, and ensure your teams are equipped to handle the spike.

At Simplify Consulting, we’re helping pension providers and platforms streamline operations, optimise processes, sharpen management information, and enhance customer communications – delivering measurable improvements in operational efficiency and customer experience. With the Pensions Dashboards set to drive a surge in service requests, we ensure your front and back-office processes are not just ready, but resilient. As dashboards evolve, we’ll stay close to the changes – so if you’re looking to future-proof your operations and turn regulatory readiness into a competitive advantage, please get in touch.

Nina Cherry

Wealth Consultant