Whilst I remain positive – I do have some worries for 2026

This week we focus on the Worries coming out of the Technology practice at Simplify.

While 2026 brings huge potential, there are several significant worries shaping the year ahead.

M&A and consolidation – acceleration is creating interconnected eco-systems and complexity risks obscuring true cost bases, will that raise uncomfortable echoes of the 2008 financial crisis and the Dot‑com era?

The skills gap is widening. Outsourcing and automation are removing foundational tasks from junior roles, meaning a loss of organically grown capability. How do firms fill these gaps?

AI costs – has heavy investment masked true operating expenses? Eventually will these costs have to flow to end-customers?

Finally, regulatory demands around resilience and third-party oversight. Will that increase the cost of doing business in 2026?

I’m worried about M&A and consolidation

Mergers and Acquisitions activity is set to accelerate in 2026, with both M&A and outsourcing reshaping financial services. While this creates transformation opportunities, it also intensifies the battle for talent.

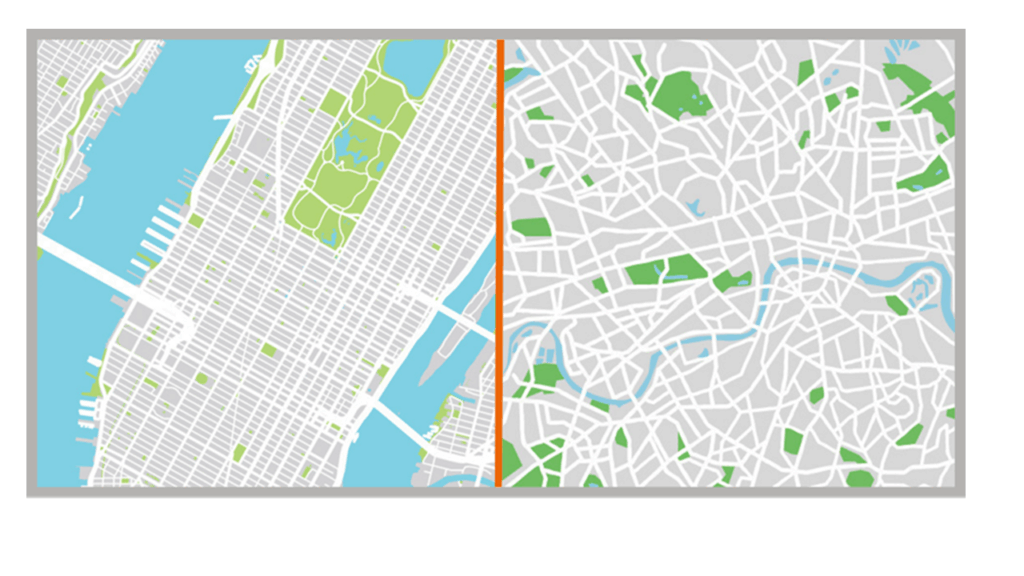

More concerning is the growing web of interconnections between cloud providers, infrastructure, AI vendors and big tech.

These hidden dependencies risk obscuring true cost bases and echo the complexity of the 2008 crisis and Dot‑com era.

The worry: one more deal could expose fragile structures and push rising costs onto customers. Are you starting to see that? Have you had an experience of legacy systems not talking to each other causing at best Operations Teams to suffer; at worse customer impact resulting in complaints.

I’m worried about the skills gap

The skills gap is widening as outsourcing and automation remove foundational tasks from junior employees.

With lower-level work absorbed by vendors and AI, essential capabilities in logic, data understanding, and structured problem solving risk disappearing from the workforce.

Tasks like writing an SQL query may no longer be required day-to-day, but the thinking behind them still matters.

These fundamentals won’t develop organically anymore; they must be deliberately trained.

Firms investing in AI cannot afford to neglect the basics and must have a people strategy that aligns to their AI strategy.

Have you already started to see roles changing, reduction in the traditional roles being carried out by robots, AI, more sophisticated tooling… What are you doing to make sure your people and processes are keeping up with or adapting to this change?

I’m worried about cost (aren’t we all)’

Is the true cost of AI being masked by heavy investment and companies operating with little or no profit expectation?

Rising demand for computational power, expanding data storage, and broader cost pressures mean underlying costs will escalate quickly.

Could this become a decisive moment for AI adoption: if the market embraces the value, AI will continue to grow, but will the financial burden have to ultimately flow down to the consumer.

Firms that are aware of this and look to how they can change or adapt their pricing models to include the benefits that AI bring could be the winners.

2026 could become a decisive moment: if the value is proven, adoption continues; if not, customers may resist the rising financial burden.

Does your budget planning include AI considerations, have you considered the underlying costs or people, processes, extra licences? If you have not…should you start?

I’m worried about regulatory change (again)

Regulatory change remains a major worry for 2026, with new technologies requiring some form of regulation and discussions almost always taking too long to be made; and then a short time to implement, firms could see an increase in time spent managing regulatory changes.

Resilience and third‑party regulations, introduced to protect consumers from large‑scale outages, are complex, costly and difficult to maintain.

My experience is that deadlines are rarely met in full, leaving ongoing backlogs.

Looking ahead, firms must decide whether to simplify their technology estates or push suppliers to become more cloud‑agnostic and transparent.

The recent cloud outage showed that even multi‑cloud isn’t foolproof — the real challenge is maintaining high resilience expectations when perfect protection is impossible.

Were you impacted by the cloud outages late in 2025, what have you changed as a result…or have you simply thought ‘it will be fine’?

My wins for 2026

‘I’m optimistic about AI’

AI is finally entering a more grounded phase in 2026 and that shift could unlock real wins for financial services.

As the hype settles, I believe organisations are recognising that meaningful value doesn’t come from big, abstract AI ambitions, but from targeted solutions that solve genuine business problems.

That’s why less un-useful human and more useful AI could be a major win this year.

Imagine:

• Truly personalised digital experiences across every channel — adaptive, relevant, and built around the customer.

• End‑to‑end efficiency gains that finally modernise legacy journeys and remove friction.

• A shift (again) in personal financial management, powered by assistants that learn, guide, and deliver actionable insights.

‘I’m optimistic about consolidation’

2026 could be a year of meaningful wins across platforms, wealth, banking, and insurance; driven by quiet but important shifts in the market.

With consolidation and outsourcing already underway, the wealth sector is entering a period of change. While this may feel “marmite” to some clients, the upside is clear: more choice. The rise of Model B propositions, and some providers moving back toward Model A, will open the door to greater flexibility and more competitive offerings.

Beyond platforms, custodians, MPS providers and DFMs are strengthening their positions and can pivot quickly; a win that should translate into better pricing, richer products, and stronger innovation for clients.

If managed well, 2026 could deliver a more diverse, agile, and client‑focused market. Tell me (in the comments) are you considering consolidation, have you started planning, does it feel like a mine-field of change and information?

‘I’m optimistic about Internet of Things (IoT)’

IoT is set to deliver some powerful wins in 2026, to my mind not through novelty, but through smarter use of the data you already generate every day.

As our world becomes increasingly metric‑driven, the volume and richness of data coming from devices, think watches, cars, homes, is growing fast. What’s changed is our ability to connect and interpret that data. Organisations can now transform raw signals into meaningful insights at scale.

What are my biggest wins this year, I hear you ask?

• Lower‑cost ways to manage and unify source data, unlocking far greater value from analytics and AI.

• A renewed focus on data architecture, ensuring insight is grounded in understanding.

• New, personalised products that deliver real benefit to both organisations and consumers.

2026 could be the year IoT becomes truly impactful. Did you know what the Internet of Things was…do you think you should know?

‘I’m optimistic about Immutability and Digital Channels’

I have saved the best for last in this week’s wins from me. Immutability and digital channels could quietly deliver some of the biggest wins in financial services this year – am I mad?

As ransomware threats rise and the FCA pushes forward with tokenised portfolio management, immutability is moving from a niche concept to a genuine strategic advantage. That’s a long‑awaited win for resilience, security, and smarter data management.

At the same time, digital channels are evolving. With a new entrant emerging who could very well be the saviour of many businesses, and my COO is very excited about this – the Financial Services AI butler. A personal assistant capable of handling routine tasks including applying for insurance to opening accounts, this opportunity represents a completely new channel for firms to design for.

The win? A more resilient, more efficient industry with smarter, more intuitive consumer experiences.

Tell me, are your ‘digital channels’ more 2016 than 2026? Are you still managing paper or clunky old systems…

Michael James

Technology Practice Director