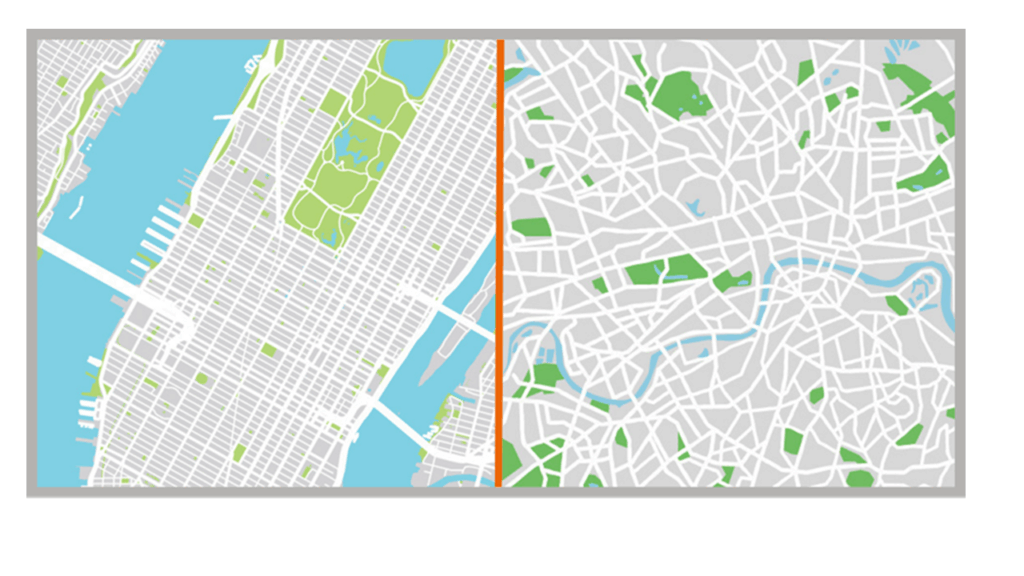

With just over a month on, we reflect on what was another great conference for the Association of Financial Mutuals (AFM) October 13-14, 2025, at The Manchester Deansgate Hotel. Simplify Consulting were delighted to attend and present at the conference, providing a rich and insightful update on the work we have been supporting the AFM on the Collaboration Project. In this initiative we are supporting the AFM to explore common services that members can benefit from access to, ranging from IT, Legal Services, Board Reviews, Customer Reconnection / Tracing and Investment Services.

Reflecting on 2025

2025 is special for the mutual insurance sector and the wider mutual and co-operative movement. The United Nations designated 2025 as the International Year of Co-operatives, celebrating and championing the principles and values that mutuals represent. In the UK specifically, the Government has committed to supporting the growth of the mutual sector, with an ambitious manifesto pledge to double its size, creating exciting opportunities for AFM members. How this will continue to unfold under the Labour government, with the looming Budget is still to be seen.

The conference took place against an impressive year for the sector. The AFM serves a record 25.5 million member-policyholders in the UK, with the sector holding approximately 8% of the UK insurance market. Between them, mutual and not-for-profit insurers manage 32 million savings, pensions, protection, and healthcare policies in the UK and Ireland, with annual premium income of ~£23 billion and holding over £200 billion in assets. As a combined force, this sector certainly punches above its weight.

Conference Themes

The conference theme “Mutuals – The Original Modern” captured the essences of what makes the sector great, with both heritage and innovation that makes the mutual market stand out from other players in their respective market. This theme explored how the sector can honour its long-standing values, given so many firms have been around for over hundred years, while finding new solutions to today’s challenges to ensure relevance to its members and customers alike.

Throughout the conference, the stand out message remained consistent to what defines the sector – as member-owned organisations with no shareholders to pay dividends to, mutuals can concentrate entirely on delivering products, and services that best meet customer needs. This distinctive approach; commercial and profit-making, but always putting people first. At Simplify, we believe this to be the sector’s “secret weapon”. The sector knows the brilliance of this but a continued focus in externalising this by firms needs to continue. Importantly, it represents a different economic and operating model that focuses on making a positive difference to members’ financial well-being through a long-term and sustainable approach.

Conference Highlights

Reflecting on the Conference, some particular highlights from Simplify Consulting include:

- Economic view/up-coming budget delivered by David Willetts (Resolution Foundation). An interesting piece on assets and wealth survey and the drag this is causing on the younger generation, who are unlikely to benefit from the baby boomers or inherit this wealth.

- Snowflake myth was shared by Alex Atherton. A thought provoking piece for firms to consider on emerging young talent in their organisations. In the presentation he explored the negative stereotypes surrounding Generation Z and practical strategies for recruiting and retaining Gen Z talent. Standout was that a significant proportion of this generation are opting to run several jobs, while they pursue their own ‘CEO’ roles as business owners.

- Industry lobbying was shared by Stephanie Blenko. With regulation and policy so closely linked to the mutual market, especially on the pure protection review, Stephanie delivered an insightful piece. It’s great to know we have an active voice on pushing the AFM voice in the corridors of Westminster

- Marketing personalisation Beth Tait and Alain Desmier shared their collective views on how OneFamily has been leveraging Contact State platform across their marketing capability. Customer segmentation and personalisation is so important in engaging members. Beth and Alain delivered several key takeaways for firms to think about. We were impressed with Beth’s team ability to generate video promotional content via AI. Whilst the ostrich inspired video wasn’t presented, this still highlights the impressive emerging capabilities in the field of marketing

- AI understandably was covered in a number of sessions through the two days, with an insightful piece by Hexaware and LV=. The session “Shaping the Future — Journey to Intelligent Operations and a Member-centric Organization” did not disappoint with lots of key takeaways for operational areas to consider

- FCA, PRA and Policy views on potential changes and impacts to the sector were shared. Particular highlight was Richard Fox at Schroders who raised a really valid point that in essence the sector will need to come together a lot like the LGPS funds to continue to provide economies of scale. In short, it’s on the AFM organisations individually and together to drive this if it is to survive.

- And lastly, a special highlight of the conference was the brilliant comedy set from Paul Sinha, known to many as “The Sinnerman” from ITV’s quiz show ‘The Chase’. Sinha, who is also a qualified medical doctor and accomplished stand-up comedian, provided entertainment at the gala dinner. One which was memorable (for all the good reasons!)

Closing thoughts by Simplify Consulting

The conference concluded with a renewed sense of purpose and momentum for the sector. The combination of Government support, the International Year of Co-operatives platform, and strong sector performance continues to create opportunities for growth. The conference did well to demonstrate that mutuals are indeed “the original modern” organisations, built on timeless values of mutuality, democracy, and member ownership, yet fully capable of embracing innovation and technology, to serve their members effectively for another 100 years.

There is no way to avoid it though, mutuals need to continue to embrace transformation through automation, digital innovation, and intelligent operations to build stronger, more member-focused organisations. With a team of industry practitioners here at Simplify Consulting, we are well placed to support these conversations, so please do get in touch.

Dan Martin

Lead Consultant